Key Financial Data

Here's the Key Financial Data for 2026. Let us know if you'd like a hard copy for your desk!

Check back here for the latest tax reporting updates from Axos Advisor Services (AAS)

Where are the tax forms?

Click here for more information on tax forms.

Important reminders as we approach the tax filing deadline

The filing deadline to submit 2025 tax returns is April, 15, 2026.

Account Applications

- IRA and ROTH IRA accounts can be established at any time; however, to make a prior year contribution, the new account documents must be in good order and the account opened by the tax filing deadline. Postmarked applications are not sufficient to accept a prior year contribution. Prior year contributions must follow requirements below.

- Applications can be uploaded to Axos Advisor Services using Liberty’s document upload feature and received by the tax filing deadline for prior year contributions to be accepted. Prior year contributions must follow requirements below.

- If an application is uploaded via Liberty, please do not send originals as this may result in duplicate accounts.

Contributions

- Prior year contributions must be made by or postmarked by the tax filing deadline – if received in your office by tax filing deadline, please provide the supporting documentation (envelope showing postmark) when forwarding the contribution to Axos Advisor Services.

- Checks/wires/ACHs must clearly indicate for which year the contribution is intended – current or prior year.

- All checks/wires/ACHs that do not state the contribution year will be posted as current year contributions.

- Axos Advisor Services must receive the wire/ACHs no later than the tax filing deadline date. It is recommended to send wires/ACHs a day or two ahead of time to ensure it is received on time. Wires/ACHs that are sent prior to tax filing but received after the tax filing deadline will be credited as a current year contribution.

- Internal transfers to an IRA/Roth IRA must have cash available on tax filing deadline date. The request must be in good order and received by the tax filing deadline date. IRS regulations do not permit in-kind contributions – contributions must be made in cash. Trades must settle by tax filing deadline date, in order to process cash movement as a prior year contribution. Trades that settle after the tax deadline will be processed as a current year contribution.

Mail Postmark for Contributions

- The postmark of the envelope is critical: Prior year contribution checks sent to Axos Advisor Services from the RIA or investor on tax filing deadline date, via overnight mail will be posted as such as per the postmark on the overnight label.

- Checks sent to Axos Advisor Services intended for a prior year contribution and received after tax filing deadline date, must have a postmark of tax filing date or earlier in order to be posted as a prior year contribution.

- Checks received by the RIA after the tax filing deadline and subsequently forwarded to Axos Advisor Services must be accompanied by the envelopes showing a postmark by tax filing deadline or earlier.

- Checks received after the tax deadline without a properly postmarked envelope will be posted as a current year contribution.

Note

If Axos Advisor Services rejects a check received on the tax filing deadline because it is not in good order, the client must place a replacement check in the mail on the same day to ensure it has the appropriate post mark.

- Any replacement checks with a postmark after the tax deadline will not be posted as a prior year contribution.

- If Axos Advisor Services posts a check for a prior year contribution that is subsequently returned by the client’s bank, the contribution will be reversed from the account. The client will need to mail a replacement check postmarked no later than tax filing deadline. All wires to replace a returned check must arrive at Axos Advisor Services no later than tax filing deadline.

For the pdf version of this information, click here.

Axos Advisor Services Tax Information

- 2025 Tax Planning Important Reminders

- 2025 AAS Tax Form Mailing Notice

- 2025 Forms 1099-R will be mailed and made available online by January 31, 2026

- Letters for account owners requiring RMDs will be mailed and made available online by January 31, 2026

All non-retirement account tax forms will be mailed and made available online February 13, 2026.

Non-retirement tax forms being mailed include Forms 1099-B, 1099-DIV, 1099-INT, 1099-MISC, and 1099-OID (as applicable), their associated detailed reports (capital gain/loss), a fee statement, if applicable and a reference sheet titled 1099 Reporting Information for 2025.

Reallocated Dividend Payments – If your clients hold a mutual fund, ETF, or Real Estate Investment Trust (REIT) in their portfolio, there is a high probability a portion of the dividend payments made throughout the year will be reallocated for tax reporting purposes. As a result, tax forms may not match the account owner’s fourth quarter statement. Due to late reallocation notices, some account owners will receive a corrected tax form.

Axos & SEM strongly recommend clients delay the filing of taxes until the last half of March due to this possibility

For mutual funds and ETFs, Axos will begin receiving reallocation information in early January. In most cases, the new information is processed in time for the original tax form mailing. Note: If the information is received after the tax forms process begins, a corrected tax form will be sent.

For REITs and Mutual Funds that hold REITs, the reallocation information is typically not received by AAS in time for the original tax form mailing due to the complex accounting necessary for REITs. Clients holding REITs should look for a corrected tax form sometime in March.

More information:

- 2025 Axos Tax Information & Mailing Time-frames for Non-Taxable Accounts

- 2025 Axos Tax Information & Mailing Time-frames for Taxable Accounts

Finding Total Fees Paid in Axos Accounts

The 2017 Tax Cut & Jobs Act eliminates the deduction for investment management fees beginning in 2018.

Importing Tax Information into Tax Preparation Software:

When tax forms are available, account owners can import their tax documents into tax preparation software such as Turbo Tax and H&R Block from Axos.

We do recommend that clients hold off till March 15th for any possible corrected 1099s.

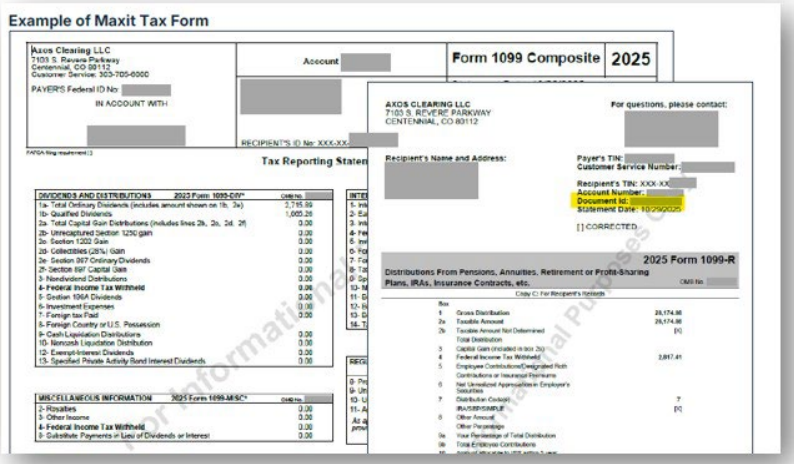

To import your Axos Tax forms into Tax Preparation software (like Turbo Tax), you can import the 1099 tax information from Liberty Online, but the Axos option they will select has changed slightly. To find your document search for ‘Axos Clearing dba Axos Advisor Services’ as the Custodian and then you will provide the Document Id

You can find the Document Id in the top right corner of the tax document. We’ve highlighted the ID in the screenshot below:

If account owners need assistance importing data from Axos into TurboTax, they are asked to contact TurboTax through the in-product Help Center, Live Community or Live Chat and Phone Support.

Explanation of Wash Sales on 1099s

Since 2012 "Wash Sales" and an entry of "Wash Sale Loss Disallowed" is shown on page 1 of the 1099. This does not mean the entire loss is disallowed, but merely deferred until they can be realized at a later date (typically by not repurchasing the same security for more than 30 days). At that time the cost basis of the shares is adjusted to essentially "realize the loss". During the last month of the year, Strategic Equity does everything possible to minimize any Wash Sale adjustments by purchasing different securities where losses were recently realized. The most difficult program to manage this in is Absolute Return Allocator. Our current procedure allows us to only have disallowed (deferred) losses during the month of December. Those losses will be able to be realized early in the following year.

Here is the explanation of Wash Sale Adjustments from TD Ameritrade:

What's a 'wash sale'?

The IRS created the wash sale rule under Section 1091 to prevent investors from recognizing "artificial" losses by selling a stock for a loss, and then repurchasing the stock within a short period of time. The wash sale "window" starts 30 days prior to the sale, includes the date of sale, and ends 30 days after the sale - for a total of 61 days. If an investor sells the stock at a loss, and then repurchases the same stock within this 61-day window, the loss is deferred until the replacement shares are sold. The pro rata loss is added to the cost basis of the replacement shares purchased, and the holding period of the replacement shares includes the holding period of the original shares sold. However, the deferred loss will eventually be recognized when the replacement shares are sold. Note: Wash Sales can be avoided by waiting to repurchase replacement shares until after the 30-day window closes. Wash sales are automatically tracked and updated in the TD AmeritradeGain Loss reports. Loss is deferred and added to the cost basis of the replacement shares, reducing Realized G/L and increasing Unrealized G/L. The opposite occurs when the replacement shares are sold and wash sales are reversed.

Client Access to Tax Information

Clients & Advisors can view all of their clients' tax information via Axos' Liberty Portal. To view your tax documents, go to "About your account", then "Tax Documents" and then click on the appropriate link to download the form.

IRS Schedule D & Form 8949

Many accountants have insisted that each individual transaction must be listed on From 8949. According to the IRS, a summary containing the same information can be attached with the summary totals listed on the schedule. For 2011, the summary would be the SEM Realized Gain/Loss Supplement. For 2012 and beyond, the 1099 will include the summary. Here is the wording from the IRS Schedule D Instructions:

Exception 1.

Instead of reporting each of your transactions on a separate row of Part I or Part II, you can report them on an attached statement containing all the same information as Parts I and II and in a similar format (i.e., description of property, dates of acquisition and disposition, proceeds, basis, adjustment and code(s), and gain or (loss)). Use as many attached statements as you need. Enter the combined totals from all your attached statements on Parts I and II with the appropriate box checked.

For example, report on Part I with box B checked all short-term gains and losses from transactions your broker reported to you on a statement showing basis was not reported to the IRS. Enter the name of the broker followed by the words “see attached statement” in column (a). Leave columns (b) and (c) blank. Enter “M” in column (f). If other codes also apply, enter all of them in column (f). Enter the totals that apply in columns (d), (e), (g), and (h). If you have statements from more than one broker, report the totals from each broker on a separate row.

Do not enter “Available upon request” and summary totals in lieu of reporting the details of each transaction on Part I or II or attached statements.

Exception 2.

You may enter summary totals instead of reporting the details of each transaction on a separate row of Part I or II or on attached statements if:

- You must report more than five transactions for that Part, and

- You file Form 1120S, 1065, or 1065-B or are a taxpayer exempt from receiving Form 1099-B, such as a corporation or exempt organization, under Regulations section 1.6045-1(c)(3)(i)(B).

If this exception applies to you, enter the summary totals on line 1. For short-term transactions, check box C at the top of Part I even if the summary totals include transactions described in the text for box A or B. For long-term transactions, check box F at the top of Part II even if the summary totals include transactions described in the text for box D or E. Enter “Available upon request” in column (a). Leave columns (b) and (c) blank. Enter “M” in column (f). If other codes also apply, enter all of them in column (f). Enter the totals that apply in columns (d), (e), (g), and (h).

Do not use a separate row for the totals from each broker. Instead, enter the summary totals from all brokers on a single row of Part I (with box C checked) or Part II (with box F checked).

Exception 3.

Form 8949 is not required for certain transactions. You may be able to aggregate those transactions and report them directly on either line 1a (for short-term transactions) or line 8a (for long-term transactions) of Schedule D. This option applies only to transactions (other than sales of collectibles) for which:

- You received a Form 1099-B (or substitute statement) that shows basis was reported to the IRS and does not show a nondeductible wash sale loss in box 5, and

- You do not need to make any adjustments to the basis or type of gain or loss (short-term or long-term) reported on Form 1099-B (or substitute statement), or to your gain or loss.

If you choose to report these transactions directly on Schedule D, you do not need to include them on Form 8949 and do not need to attach a statement. For more information, see the Schedule D instructions.

If you qualify to use Exception 3 and also qualify to use Exception 1 or Exception 2, you can use both (Exception 3 plus either Exception 1 or Exception 2). Report the transactions that qualify for Exception 3 directly on either line 1a or 8a of Schedule D, whichever applies. Report the rest of your transactions as explained in Exception 1 or Exception 2, whichever applies.

E-file. If you e-file your return but choose not to report each transaction on a separate row on the electronic return, you must either (a) include Form 8949 as a PDF attachment to your return or (b) attach Form 8949 to Form 8453 (or the appropriate form in the Form 8453 series) and mail the forms to the IRS. You can attach one or more statements containing all the same information as Form 8949, instead of attaching Form 8949, if the statements are in a format similar to Form 8949.

However, this does not apply to transactions that qualify for Exception 2 or Exception 3. In those cases, neither an attachment, a statement, nor Form 8453 is required.

SOURCE: http://www.irs.gov/instructions/i8949/ch02.html

Required Minimum Distributions

Click here for some alternative giving strategies

At the end of January, Axos Advisor Services sends notification letters and forms to all RMD eligible account holders. This is a required mailing. If a client already has established systematic RMDs and wishes to remain with the same schedule no further action is required. Axos will include a form to establish or change systematic RMDs.

If you utilized a Qualified Charitable Distribution (QCD) to fulfill your RMD, please note it is up to you to properly report this on your tax form. Here is the guidance from the IRS:

How do I report a qualified charitable distribution on my income tax return?

To report a qualified charitable distribution on your Form 1040 tax return, you generally report the full amount of the charitable distribution on the line for IRA distributions. On the line for the taxable amount, enter zero if the full amount was a qualified charitable distribution. Enter "QCD" next to this line. See the Form 1040 instructions for additional information.

You must also file Form 8606, Nondeductible IRAs, if:

- You made the qualified charitable distribution from a traditional IRA in which you had basis and received a distribution from the IRA during the same year, other than the qualified charitable distribution; or

- The qualified charitable distribution was made from a Roth IRA.

Please keep in mind that if your clients do not take their RMD when required, the IRS may impose a 50% penalty on the amount not distributed.