What's the difference between traditional finances and behavioral finance?

Traditional = focuses on what you SHOULD do

Behavioral = focuses on what you are LIKELY to do

Critical Research Supporting Behavioral Finance

The two psychologists, Dr. Kahneman & Tversky's work centered around how the human brain works. Through hundreds of clinical tests they discovered our brain has two decision making components -- the fast brain and the slow brain. The fast brain is your "instincts" or things that do not require much thinking. It was originally thought the slow brain was a workhorse, but their tests showed the slow brain is lazy and uses heuristics, or mental short-cuts to make decisions. Through this, Kahneman & Tversky identified dozens of behavioral biases that impact our ability to make wise decisions.

Dr. Thaler, who had studied under Kahneman & Tversky felt uncomfortable with some of the theories economists were using. He started a list of things humans did that did not match what economists said they would. Through this, and a long series of tests he learned while economists assume all people will behave rationally, in reality, humans tend to behave in a way economists would call irrational.

SEM's Behavioral Approach centers around creating a plan customized to meet the needs of the individual investor. The foundation of this is a complete financial plan and cash flow strategy. SEM's role begins with the investment plan. Given the unlimited number of investment allocations that can be generated, this is the place many of the heuristics (mental shortcuts) identified by Dr. Kahneman come into play. Improper execution of this phase of the plan can cause the client to not stick to their financial plan.

Common Advisor Cognitive Errors

Conservatism

Confirmation

Representativeness

Illusion of Control

Availability

Hindsight

Common Advisor Emotional Biases

Overconfidence

Self-control

Status Quo

Regret / Loss Aversion

Using Behavioral Tricks to Create Customized Portfolios

Over the long-run stocks should out-perform nearly every other investment out there. Because of this, we know investors SHOULD stay invested in stocks for the long-run. Studies have shown most investors will not stay the course as they are likely to react emotionally at some point in their investment journey.

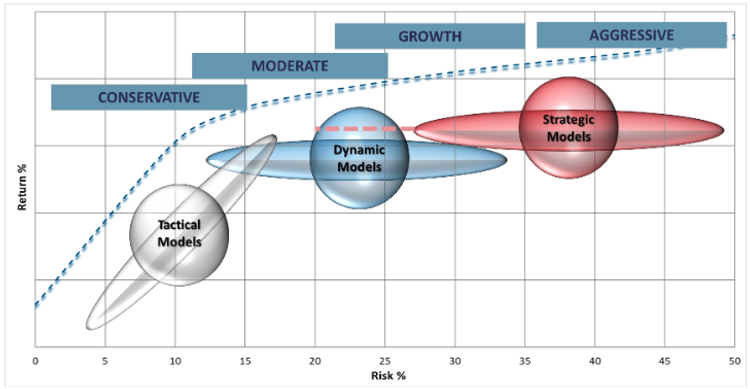

A behavioral approach to investing adapts investment portfolios to what investors likely WILL do. Each investor has their own specific biases, but generally speaking, those biases can be grouped into categories. Conservative investors all tend to have certain biases, which will be different than Growth investors. This means investment portfolios need to be allocated differently for each type of client.

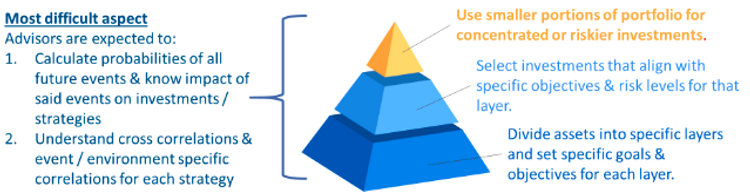

This goes far beyond the typical stock/bond portfolios used in traditional finance. A behavioral approach uses distinct management styles and asset "buckets" to "trick" our brains into doing what we SHOULD be doing. It may not be the perfect approach on paper, but the goal is to make sure the investor sticks to the long-term plan.

In addition, a behavioral approach demands different styles of communications at different parts of the market cycle for the various investor types. The upside is rather than constantly telling clients what they SHOULD be doing, a behavioral advisor will spend more time working on the long-term financial plan.